|

When you are looking for a partner or contractor the most important step is verifying the business registration for a company. For this the good news is there are multiple ways through which you can check if the business is registered by the united states. Some of them are: Check with the State Business Department There is no central business registration in the United States. Businesses are registered with the state governments in the states where they are headquartered. To check if a business is registered with the state, you can contact the Secretary of State's office in that state. In order to find contact information for the Secretary of State's office in a particular state, you can visit the website of the National Association of Secretaries of State. Use Online National Directories One way to check if someone is registered is to look them up in an online national directory. There are many online directories that list in the United States, and most of them are free to search. There are a few ways that you can use online national directories to check if a business is legitimate. One way is to check the Better Business Bureau's website. You can also do a search on the business name in Google. If there are any negative reviews or articles about the business, that is a red flag that you should avoid doing business with them. Another way to check if a business is legitimate is to look up their address in an online national directory. If the address is not listed, that is another red flag. You should also avoid doing business with any businesses that have a P.O. Box for an address. Finally, you can contact the Better Business Bureau and ask them if they have any information about the business. If the business is not listed with the BBB, that is a definite red flag. Check the Patent and Trademark Office In order to check the registration of a company through patent and trademark office you should first go to the United States Patent and Trade Mark Office. From there you should look for “find it fast” section from where you can search the directories. Use the SEC’s EDGAR The SEC's EDGAR system can be used to find information about the registration of a company. • Go to the SEC's website at https://www.sec.gov/. • Under the "Filings & Forms" heading, click on the "EDGAR Company Filings" link. • Enter the name of the company in the search box and click "Search." • Click on the company's name in the search results. • Click on the "Registration Statement" link. • Scroll down to the "Registration Statement" section. • Click on the "Company Registration Statement" link. • Review the information in the registration statement. Not Every Business is Registered Before you start looking for the right business to work with it is important to understand that not every business is registered with the state. So, there are plenty of businesses that are not necessarily in the good books which are still operating (illegally) or as a sole proprietorship which is legal and requires no or little paperwork.. If the business is not registered, you may want to consider another business instead. Article for Cox Business News by Maheen Kashif

0 Comments

How to sell your website Selling your website or online business might seem like a complicated process. When you add in steps to try to maximize the value pre-sale, things get even more complex. Below, we outline a 7-step process that will help you navigate this challenge. 1. Diversify Your Traffic Sources If your business is currently relying primarily on paid traffic and ads, you should diversify your traffic sources before considering a sale. In particular, you want to focus on increasing your organic traffic. Organic sources of traffic have higher profit margins, but that’s not all. Experienced buyers and brokers put a lot of value on long-term stability and ease of management. 2. Create Processes and Use Third-party Services Some types of websites and ecommerce stores require more involvement than others. If you are running an ecommerce store and are currently fulfilling your orders yourself, you should change that before selling the business. You must minimize your involvement in the business as much as possible before selling it. Potential buyers who have the capital to buy a business for a flat fee of tens of thousands of dollars aren’t looking for another full-time job. They are looking for ready-made investment opportunities. That typically means a business that’s automated and requires very little hands-on work. 3. Get Your Financials and Traffic Reports in Order Nobody is going to invest in a business that doesn’t have evidence of its finances and assets. If one of your online business assets is organic traffic or a social media following, take steps to document this properly. Keep in mind that marketplaces and brokers require months of verified financial and traffic reports. So make sure that you have installed Google Analytics or an alternative on your website. Sales reports can typically just be exported from any ecommerce tool and are less of an issue. 4. Choose the Right Marketplace or Broker Once you’ve dotted your i’s and crossed your t’s, it’s time to move on to the selling part. The first part is choosing the right place to sell it. 5. Know Your Potential Buyer and Customize Your Sales Page When you’re creating a page to sell your website, you need to know who your prospective buyers are and what they are looking for in a website. Watch this interview Empire Flippers did with a buyer and listen to his priorities and his fears. 6. Prepare Your Team or Virtual Assistants for the Sale Once you’ve decided to sell the business, you need to prepare everyone involved for the potential transfer of ownership. Ensure all the stakeholders understand the situation and that the core members are ready to help the buyer transition into the role of owner/operator. 7. Know What Your Site is Worth To avoid losing big, you need to know what your website is worth. Before you pull the trigger and sell your website, you should have a rough idea of what it could bring in. Article by patrick matthew for Cox Business NewsCrowdfunding with mainvest for startups It's a bit like crowdfunding platforms Kickstarter and Indiegogo, but instead of contributing money in exchange for an early version of a product, MainVest investors are actually lending money. They do so through a special kind of debt instrument that pays them back via a percentage of the business's revenue. MainVest co-founder and CEO Nick Mathews hopes the idea will solve two problems. On one hand, small businesses have a harder time accessing capital than fast-growing tech startups, especially since banks have been more cautious about giving out commercial lines of credit in the wake of the recession. On the other hand, many people are locked out of investing in the most promising companies due to lack of knowledge or because they're not accredited investors. MainVest aims to bring the two sides together, providing investors with a pool of opportunities and businesses with a suite of tools to help them corral a herd of investors and handle all the necessary regulatory paperwork. This type of online fundraising was made possible by the federal JOBS Act in 2012. The U.S. Securities and Exchange Commission put final regulations into place in 2016. “It allows people to actually vote with their wallets and really have a say in shaping their communities,” Mathews said. “Businesses are going to have local allies and local evangelists, and they’ll have a competitive advantage in the market.” Mathews, who incorporated MainVest this spring along with co-founder Ben Blieden, was previously an early Uber employee and helped launch the ride-hailing service in the Northeast. “That first three years at Uber, our mission and our belief was really around economic empowerment” for drivers, Mathews said. In his view, that mission faded as the company grew, but he began to look for new ways to support independent business owners. Mathews said MainVest has been working with economic development agencies in multiple cities to identify businesses that might be interested in the site, which takes a 6 percent cut of successful fundraising campaigns. When MainVest launches this fall, it will have between 10 and 30 profiles for businesses in the Greater Boston area, Mathews said. One of them will likely be Wears Woody, a Cape Cod-born beachwear retailer that wants to raise money for its first brick-and-mortar location. Wears Woody founder Mike Norwood said he's always taken an unconventional approach to growing the company, which started off selling flip-flops and sunglasses to beachgoers out of the back of a station wagon named Woody. He sees MainVest as a way to raise outside funding for the first time while still remaining true to Wears Woody's loyal customer base. “We want to make stuff differently, we want to market it differently, and sell it differently," Norwood said. " I see MainVest as a vehicle for us to be able to legitimately and with structure fundraise and galvanize a community for us that we know exists." The retailer also donates 25 percent of its profits to diabetes-related nonprofits, and Norwood hopes people from that community will contribute to the funding as well. Wears Woody will likely try to raise enough money to build out a physical location somewhere in Greater Boston that combines a retail shop with a lounge-style space for customers and an inventory warehouse. edit. Article by patrick matthew for Cox Business NewsThe internet has made it very easy to interact with multiple businesses for multiple purposes. But the downside is the cybercrime and the criminals that can hack our devices and can steal our information. Fortunately we have some methods through which we can identify if the online business is legitimate or not. Check the URL First, make sure you have the correct web address. If you find yourself on the wrong website, do a web search for the company, product, or service you’re looking for. • Look for signs of a secure website Look for a URL that begins with “https:”—the “s” stands for “secure.” • A padlock or unbroken key (depending on your browser) in the browser’s address bar while viewing a website is also a good indicator of a site’s security. • Check your browser’s security settings. • You can also access your browser’s settings to ensure that it alerts you to suspicious or fake websites. Look closely at the content If the site's content is well-written and free of grammar and spelling errors, it is more likely to be a legitimate site. If the site's content is poorly written and full of grammar and spelling errors, it is less likely to be a legitimate site.

If the site provides a physical address, email address, and/or phone number it is more likely to be a legitimate site. If the site does not provide any contact information, it is less likely to be a legitimate site. Find out who owns the web domain To find out who owns a web domain, you can use a WHOIS search. A WHOIS search will show you the registrant (owner) of a domain name, as well as their contact information. This can be useful if you're trying to figure out if a website is legitimate, or if you're trying to contact the owner of a website. To do a WHOIS search, you can go to a WHOIS search site like Whois.net or Whoisology.com. Check for reviews You can also check the reviews of a website in order to know if the site is legit or not. for this a good place to start is the Better Business Bureau's website. You can search for the website in question and see if there are any complaints or reviews. Another good place to look is SiteJabber, which has reviews of all types of websites. Check for a privacy policy Some companies will post a privacy policy on their website. This helps you learn how your information will be used and helps you hold the company accountable for their actions. You can easily search the web for the company’s privacy policy. If you can’t find it, you may want to choose another company to work with.. A turning point that is essential to know what is the market value of your business. This information helps you in selling your business. The most important thing is how can you convince the buyer to buy your business. It's also important to know the site where you have buyers related to your business. Here I would like to break down the points you can get the best way to increase the chances of selling your website. Reach out to the targeted audience: When you identify the buyer you can improve, and modify the website so that buyer shows interest. Your work must according to the market. Long-time projects going on your website help you in selling. Make sure the audience will like your work and it will encourage the audience to buy your project. Once you have identified the right kind of buyer you should approach them in the right way. Value of your website: You should have the idea before creating the page. there is a difference between what you think is the worth of the business and what the buyer is willing to pay. To avoid a big loss, you need to know what your website worth is. Your website must have the potential for long time growth and revenue. For example, if your content is ranking on google for a long time the bidders will attract to buy. Select the best marketplace: First thing is to choose a good marketplace where you will get maximum profit and revenue. . Auction is the platform where buyers can place bids for your business. Philippa, I suggest you select flippa because it is the best for startups and smaller websites. A broker will help you to find investors and negotiate the price with investors. investment bank this is also a platform and it is for larger deals which means millions of dollars. Why buyer would pay you a premium? To maximize what buyers offer you, keep the focus on two core things: Return on investment and relative risks. The business has fewer risks and also has a higher premium. Risky businesses with lower profits will fall lower-earning scale and be difficult to sell. Investor often invests their money where the chances of profit are much higher than they invest. If your website has credibility, effectiveness, and attraction you will be able to sell easily. Optimize your profit margin: As above SEO is a necessary tool to know the audience target and the requirements of the buyer. I say it is the backbone of an authentic and reliable website. Usually, buyers ask the owner and manager of the website, "is your website optimized"? If yes they will negotiate with the owner and if the answer is no, they won't think twice and will move on next thing. However, there is a question why is optimizing your website while you are selling it.? It may help in ranking each page on google and buyer can estimate why your website is better than others.

A turning point that is essential to growing your business is " what is worthy of your website". you are going to sell your website one thing to keep in your mind is how much value your business has. The most important thing is you should pre-estimate where you can reach out to the buyer who will be able to pay the appropriate payback. Here I would like to break down the points you can get the best way to increase the chances of selling the website. Reach out to the targeted audience: When you identify your targeted audience, you can improve, and modify the website to suit the interest of your potential buyer. Your work should be according to the trend. And evaluate the long-term project will help you to sell a website and generate profitable revenue. Make sure the audience will like your work and it will encourage the audience to buy your project. Once you have identified the right kind of buyer you should approach them in the right way. Value of your website: You should have the idea before creating the page. there is a difference between what you think is the worth of the business and what the buyer is willing to pay. To avoid a big loss, you need to know what your website worth is. Your website must have the potential for long time growth and revenue. For example, if your content is ranking on google for a long time the bidders will attract to buy. Select the best marketplace: First thing is to choose a good marketplace where you will get maximum profit and revenue. . Auction is the platform where buyers can place bids for your business. Philippa, I suggest you select flippa because it is the best for startups and smaller websites. A broker will help you to find investors and negotiate the price with investors. investment bank this is also a platform and it is for larger deals which means millions of dollars. Why buyer would pay you a premium? To maximize what buyers offer you, keep the focus on two core things: Return on investment and relative risks. The business has fewer risks and also has a higher premium. Risky businesses with lower profits will fall lower-earning scale and be difficult to sell. Investor often invests their money where the chances of profit are much higher than they invest. If your website has credibility, effectiveness, and attraction you will be able to sell easily. Optimize your profit margin: As above SEO is a necessary tool to know the audience target and the requirements of the buyer. I say it is the backbone of an authentic and reliable website. Usually, buyers ask the owner and manager of the website, "is your website optimized"? If yes they will negotiate with the owner and if the answer is no, they won't think twice and will move on next thing. However, there is a question why is optimizing your website while you are selling it.? It may help in ranking each page on google and buyer can estimate why your website is better than others.

A sale-leaseback is an agreement between seller and buyer. The seller sells the property to the buyer for some time. In commercial real estate, the property involved is a building, the land itself. The seller agrees on these terms and conditions that he pays all taxes, maintenance, and all others. The control and use of the property is a vital factors for real estate users. Real estate leaseback takes place for a long period it may be in several years. Convert assets into cash: In a sale-leaseback, the seller gains his property after the agreement end. At the same time seller adjust his terms for leaseback. The seller takes a handsome amount after giving his assets to leaseback. The seller may receive 100% market value of his property. This way the owner has an opportunity to convert his property into cash and the property remains his own. A new way of financing: A seller can structure the initial term and condition of the lease that meet his needs. All burdens can be removed by the seller to adjust the time frame and all basic things by himself. Nowadays it has become a new way of financing. Sellers can make new terms and conditions according to their needs. Under a sale-leaseback arrangement, a buyer can choose better financing terms than the property owner. If the property owner wants to continue the leaseback agreement then the buyer can also. It depends on both parties' agreement to extend the time. Advantages of sale-leaseback in real estate: There are some advantages of real estate sale-back. ⦁ Cost recovery in this transaction method is easy. Depreciation also recovers when the seller sold the property. ⦁ If you add interest rate as a period of time passes it can be used as a tax payment. ⦁ Its main benefit is that you remain the owner of your property after selling it. ⦁ You are not bonded to anyone in selling, or improving the property and in terms of the agreement. Bottom lines: A sale-leaseback transaction is an attractive method in real estate. If you have owned property and want to lease it, this gives you financial benefits. It may be a building, warehouse, or even a part of the land. You can also put a point to increase your cash every year or you may take it at the start. If you are taking land on the lease you need to understand the value of the agreement and its legal aspect. The seller also views all these points deeply. As a seller, you need to first protect your assets legally and then move further. If you want to lease land as a seller or as buyer i hope this material could help you in this regard. In real estate factor saleleaseback is high in demand because if you want to start a business you need land. First you try to take land on lease then after successful business you can take your own property.

Business loans for real estate transaction with bad credit. Bad credit is the main hurdle in obtaining loans for the commercial real estate businesses. However, these low credit scores will not inhibit you always from getting small business loans. Whenever any businessperson requires a bad credit loan, the business person should make use of personal credit resources and business credit resources. Try getting a Pre-Qualification for Loan, however when a business has poor cash flow and bad credit, banks and lenders focus on documented financial history and assets of the business instead of your credit score. To qualify for a business loan with bad credit you could follow these steps: Improving personal credit: Personal credit can be improved by reviewing credit reports, making on-time payments, lower credit usage, and removing late payments as well as Improving your businesses credit score: Improving your credit score can be improved by making a line of credit, on-time payments, separation of business and personal expenses, and incorporating your business or making an LLC. Loans available for bad credit Bad credit business loans have different types based on terms & conditions and qualifications. Other than banks and traditional lenders, some alternative lenders such as online lenders are available to offer small business loans. The following types of business loans are provided for small businesses by traditional and alternative lenders: Term loans: Term loans are provided to borrowers as lump sums with certain terms & conditions of paying fixed amounts to their lenders. Line of credits: A line of credits is similar to business credit cards provided to government and businesses to help the borrowers in cash flow crises. With a business line of credit, a pool of funds known as a revolving line of credit is approved by the lender which is to be returned with interest amount. Invoice Financing: If a small business has cash flow issues due to a lack of balances & payments by customers, invoice financing is the best option to deal with. In invoice financing, the business can sell their invoices to their lender at discounted rates and receive advance amounts on them. Merchant Cash Advance: It is a cash advance provided to a business on the future sales of one’s business in exchange for a percentage amount of future credit and debit card sales. The lenders provide the business with a cash advance in which they pay back a percentage of their customer’s repayments.

Peer-to-Peer Loans Peer-to-peer loans or peer-to-peer lending is an online system of lending money to individuals and businesses through an online platform. This is a new platform where individual lenders and borrowers directly connect by cutting out middleman expenses. On peer-to-peer sites, the lists of loan amounts are posted online. Eligible borrowers indicate the proposed loan amounts, and purpose of the loan and then apply for the loan amount. Secured Commercial loans A good option for obtaining a loan is through a secured commercial loan. In a secured commercial loan plan, the borrowers can get a loan in exchange for some assets in form of collateral. In case of failure in repayment of a loan, the lender might ask and claim for any assets that the borrower owns. Getting loans with bad credits can be a big mission to undertake but still paying them promptly will improve credit ratings. How to sell a website

What is a sale-leaseback program? It's a financial agreement between two parties. The seller party becomes the lease and the new owner becomes the leaser. It's a unique procedure of financing for long terms. In a sale-leaseback, you sell your equipment, land, or anything else that the buyer needs to it. An agreement between two parties for the period is usually for the long term. A new buyer bond to return the asset to the previous owner after an agreement expire. If you want to take something on the lease we provide you with all the necessary information. We also provide information as a seller. We discuss benefits and compare them with loans also. When do I need a sale-leaseback? Why do you need to sell-leaseback a thing, property, and any equipment you own? It's all matter of money. When you have an asset that is valuable in the market you can sell it as a leaseback. It increases your wealth and you can focus more on your project. When you feel that your company needs cash to run you can also sell-leaseback some equipment. It's most important in the real estate sector where you give land for some time. You can also use this opportunity when a third party needs something valuable to them. How much financing recover? Sale-leaseback is helpful in financing. It increases your company's credit and improves your balance sheet. This factor depends on the condition of your equipment and its market value. Many factors affect the value and cash you get from it. It depends on the asset customer available in the market this factor all effect value. You may get 50 to 100 percent value of your asset. There is no fixed limit to it. If you have an asset in the marketplace and have customers you can get a handsome amount. Working Principle of sale-leaseback: In the real estate sector leaseback transactions follow two rules to carry on the agreement. 1) Property owners agree to sell it to investors for some time at a fixed price. 2) The new owner agrees on terms and conditions. He also agrees to lease the property back to the occupant for a long-term period. These rules of the agreement allow the seller to remain the occupant of the property. Same as the rule for all assets under the lease. So, seller and buyer generate cash flow. Compare loan and sale-leaseback: Sale-leaseback looks like a loan but it has many different aspects as compared to a loan. Are you thinking about that are you taking a loan? or giving an asset as a leaseback? This factor depends on you how much you need capital. You can also compare both loan and leaseback. If you get the same situation when you get a loan and the same as a leaseback. Then leaseback is your 1st priority. The loan you get is shown on your company cash sheet. Leaseback provides you with benefits that you remain the owner of your asset and get a handsome amount. It maintains your company's reputation.

How Long Does A Credit Card Balance Transfer Take? A credit card balance transfer usually takes five to seven days to process, although some large credit card issuers require clients to wait up to 14 or even 21 days. Read on if you're thinking about acquiring a new balance transfer credit card and want to be sure you know how long the transfer will take and whether you should make one at all. How does a balance transfer credit card work? A balance transfer credit card allows you to transfer a portion or all of the balance from another credit card or store card to your Capital business or personal credit card. Small business entrepreneurs can get a revolving line of credit with a set amount using a capital business credit card. A small business owner determines which employees are eligible for a company credit card. However a capital business credit card, like a consumer credit card, charges interest if the balance transfer is not a full payment. Balance transfers are handled differently by different credit card companies. Some firms handle balance transfers electronically, while others send you balance transfer cheques to mail to the credit cards you're paying off. Some credit card companies will let you transfer debt from a school loan, a personal loan, an auto loan, or a home equity line of credit to your credit card. Why does transferring a credit card balance take so long? It can be unpleasant to wait for a balance transfer from one credit card to another to complete, especially if you have a payment due soon. Here's how long it might take with some credit card companies. Not withstanding what has been said in the first paragraph of this article,depending on your card issuer, a balance transfer could also take up to six weeks to appear in the account you're transferring the money to. While many issuers can complete the procedure in a week or less, it's not a situation where you can "set it and forget it." You can track the progress of the transfer by checking your accounts. More so your new card issuer will need to organize the balance transfer with your previous sender once you've been accepted for a balance transfer. As promised in the first paragraph of this article, we’ve put together a top list of credit card issuers below,if you're thinking about acquiring a new balance transfer credit card. Top Best Balance Transfer Credit Card Wells Fargo Reflect℠ Card U.S. Bank Visa® Platinum Card Citi ® Double cash card Bank Americard ® Credit ® Card Chase Slate Edge Citi ® Diamond Preferred ® Card Citi Simplicity ® Card Citi Rewards +® Card Chase Freedom Flex℠ Navy Federal Credit Union Platinum Credit Card This article was proudly written

1. Get a Hard Money LoanGetting a loan from a hard money lender is a great option for real estate investors with bad credit or less than stellar credit. Despite its name, “hard” money isn’t hard to come by its actually suer easy — it’s literally anywhere you look it seems like. Hard money lenders are private firms or individuals or or even a group of friends who offer short-term loans that are backed by real estate. These lenders are only interested in investment deals — they aren’t funding someone who wants to buy a house to live in typically. The best part is that hard money loans can give you funds very quickly — often, within days. That’s why so many real estate investors use this source. They’re quick, painless, and easy to turn around. Hard money lenders don’t consider credit scores as the “be all, end all.” They can determine who they lend to and what those loans look like. If your credit score is good, GREAT! But if not, your application is still more than welcome. The majority of the time, hard money lenders only care about one thing: if the deal is a good deal. Their main concern is the value of the home. If the numbers work, they’ll more than likely fund the deal, whether you walk in with a 780 credit score or not. A hard money lender will use the property as collateral. If you don’t pay them back, they take ownership of the property. That’s why they care about the numbers. If you bottom out, they’ll still make money. So, if you have a solid deal on your hands with good profit potential, a hard money lender will likely fund it — even if your credit score is just . . . eh. #2. Look For Private Money LendersAnother funding source to consider is private money lenders Private money can come from anyone looking for a return on their investment. This can be anyone from a structured lender to a friend, relative, business partner or acquaintance. Even if your credit score isn’t great, private money lenders can still lend to you, often with competitive terms. The quality and value of your deal are much more important to a private money lender than your credit score. Private money lenders don’t abide by a certain set of rules. So repayment terms, interest, and everything else is up for negotiation. And because it’s that person’s own cash, they decide whether or not they run your credit. If you can show your deal has value and that you can close quickly — and make a profit quickly -- private money lenders can overlook dings on your credit report.  #3. Consider Wholesaling/Flipping via an option to purchase.

A NEW Blowout way, to advertise your business to other local businesses and there workforce4/15/2022 Contact busineeses without spamming them, and by sending emails to what is normally there main email account with this new low cost service to gain businesses and there employees as customersBad credit funding at 1% a month? .....................What is the catch, and who can apply!4/10/2022 Our newest business funding program, is a miracle for real estate owners who have horrible credit or no credit and want a low cost way to raise funds. With this program your credit rating does not matter. With this program you will pay about 1% a month (roughly) of the amount of funding you originally received. With this program you can receive up to 10 years to pay. But? whats the catch with this program?

Find out which MCA funder recently threatened physical violence after ... missed payments.”8/7/2021 Par funding executives have been through allot recently, including according to court documents, making physical threats of violence to reduce default rates according to allegations in court documents.So after spending hours reading the legal complaint court document, I have all the Juicy details for you! First of all, some background, the subject of this article is the multi million dollar MCA funder known as Par funding, who touted an amazing "1 percent default rate" to its investors according to the legal complaint on all business funding deals , and steady monthly paid interest payments to investors at 1% per month often. Court Documents state 1 % default is from "onsite inspections" according to managment from Par Funding, also in court documents merchants alleged that Par funding "sent someone to visit me was when...... threatened me with physical violence after I missed payments.”The globe has seen a devastating economic impact as the Covid-19 outbreak has been a disease spreading drastically. Owing to the negative impact the Covid-19 pandemic has caused on most businesses the globe has then suffered a huge threat in its economy. In an attempt to manage the spread of this deadly virus most countries issued total lockdowns in their entire region, restriction of traveling across countries globally, which is a major means with which most businesses generate their revenue. The businesses that were not remotely organized were perpetually shut down and only those that offer very essential services were left open with strict principles of operation leaving the global economy adversely affected. Some of the businesses that were negatively impacted by the Covid-19 pandemic include: Hospitality Industry:This industry/business sector gets its sales mostly from people that are used to traveling, as they find a place to lodge and rest. Since a total restriction was placed on traveling within a country and overseas, businesses were shut down, and social distancing was ensured, this business sector suffered a deep loss in its revenue, also, its workers were affected; as some were sacked from work and others suffered a loss in hours of operation. It is no doubt that this business sector is one of the major industries that received the hardest strike because of the lockdown and travel restriction that constrained travelers from across the nation and the globe. Tourism and Aviation:This business sector is also one of the eminent industries that got struck hard, as there was a little in demand among travelers because of the lockdown and travel restrictions. A good number of both the developed and underdeveloped countries with local and foreign airlines have suspended all activities, with the entire airport in each country under a shutdown according to the order given by the Federal Government. A report that was circulated in March by the International Air Transport Association (IATA) gave an estimate of the loss the business sector suffered from a figure which was roughly over $252 billion in the globe altogether. Real Estate and Construction:The restriction order the federal government gave on the masses movement and the policy that was also introduced which entails 2 meters distancing (social distancing) seriously affected the possible rendered services in construction activities in the globe entirely with individuals and organizations trying to introduce safety measures that will help them manage the spread of the virus. Also, only a little number of property buyers will attempt to acquire houses since there is already a loss of interest due to the negative impact Covid-19 caused in the world economy, which includes; drop in income, loss of jobs, and loss in hours of operation. Cinemas and Entertainment:One of the big industries that also have a vast urge from the masses is the Film and Entertainment Industry. In general, this industry has experienced a significant negative impact; most of the activities carried out in the cinema could not function, including movie theatres, movie premiers, musical concerts, and art exhibitions that have been equally canceled while some postponed. The Covid-19 outbreak so many strikes this industry negatively to the point of the business sector losing a multi-billion worth of deals. Trade:The trade sector can't escape through the negative impact the Covid-19 has caused in the world economy, this is owing to the shutdown order given by the federal government on factories, the shutdown order on the factories caused limited access to commodities and raw materials due to the challenged faced in the supply chain. Due to the lockdowns, closure of seaports, and closure of borders billions of dollars will be lost on imports and export trade. China, a major country which with its current integration is crucial to worldwide trade in the main supplier and value chain and buyers of average inputs, its trade will likewise be affected due to the disruption it is dealing with in respect to the disease. Oil and Gas Industry:This industry is also largely affected by the Covid-19 outbreak, the restrictions given on movement have led to a huge drop in the oil demand, it has also led to a drop in the prices of crude oil around the globe. Many attempts were made to help balance the loss and profit of the Oil and Gas industry, one major attempt was the coming of the Organization of the Petroleum Exporting Countries (OPEC) and other top oil-producing countries through a means called output cut, all these have still not helped in improving the negative impact Covid-19 caused on the industry nor stabilize the industry market. Manufacturing:The lockdown order which also triggered low purchases from customers, the shutdown of factories and production lines have also hurt the manufacturing sector. Consultants and Services:Another sector that is negatively affected is the Consultant and Service provider. The crash in revenue by government institutions and companies which is due to the meltdown in the global economy resulted in tightened budgets which perpetually affected the consultants negatively. Start-ups and Small businesses:Many businesses were likewise affected by the lockdown order given by the government because of the covid-19 outbreak. Business people were forced to take quick actions to maintain their status and position in the business. Startups have been left as one of the most vulnerable businesses due to the preventive measure taken by the government to curb the spread of Covid-19. SPECIAL LOANS AVAILABLE FOR COVID-19 AFFECTED BUSINESSESMany businesses find it very difficult to accurately analyze how their gross income will be affected by COVID-19 owing to a series of unidentified factors the pandemic has caused. One of the noticeable products of Covid-19 is the huge economic shock it has brought on so many businesses and the world as a whole; nevertheless, the coronavirus will also convert and affect business in some other ways. Some businesses that involve in technologies and shopping platforms will continue to make sales and keep playing a fresh important position even after the Covid-19 pandemic has wiped off, while businesses whose sales depend on shifting location and face-to-face interaction would be suffering from broken sales and incomes. In the tip of March, several businesses complained that their sales revenue dropped back by about minus 6 percent in respect to the coronavirus-related development Due to the disaster, the Covid-19 pandemic has caused to the majority of businesses run around the globe, certain loans are then made available to support these businesses from running bankrupt. The special loans made available for business affected by the Covid-19 pandemic are listed below: A. CORONAVIRUS BUSINESS INTERRUPTION LOAN SCHEME (CBILS):The Coronavirus Business Interruption Loan Scheme (CBILS) can make available facilities that are up to five million euros (E5m) for business with smaller revenue across the United Kingdom; the British Business Bank’s roster of 40+ accredited lenders is the means with which the Coronavirus Business Interruption Loan Scheme (CBILS) is delivered. The range of business finance facilities supported by the Coronavirus Business Interruption Loan Scheme (CBILS) includes overdrafts, term loans, invoice finance, and asset finance. CBILS was launched at the tip of March and will be accessible for applications within the time frame of six months, there is likewise a possibility that the six month period of application extend if the Covid-19 pandemic period does not stop). FEATURES OF THE CBILS SCHEME

For the Coronavirus Business Interruption Loan Scheme, the government gave certain principles that show eligible individuals

B. CORONAVIRUS BOUNCE BACK LOAN SCHEME (CBBLS):The United Kingdom declared a special loan with the name “Bounce Bank Loan” scheme (CBBLS) this loan will be dispensed through a government network of purported “accredited lenders”, including all the important financial institutions already included on the government’s list of accredited for CBILS. FEATURES OF THE CBBLS SCHEME

Any business that is in alignment with the following criteria can apply for the Coronavirus Bounce Back Loan Scheme (CBBLS):

C. OPEN FOR BUSINESS LOAN PROGRAM:The Covid-19 pandemic has negatively affected many local and small businesses in the Kerr-Tar Regional. The Kerr-Tar Region Council of Governments then attempted to help the businesses in this region with a loan program known as “Open for Business Loan Program.” This reason this loan program is set down is to assist the business that is still small and medium based on their revenue to recuperate from the negative effect the Covid-19 economic FEATURES OF THE OPEN FOR BUSINESS LOAN PROGRAM

Open for Business Loan is a non-venial interest-free loan, which ranges from $10,000 - $100,000.

D. PAYCHECK PROTECTION PROGRAM (PPP)The Paycheck Protection Program is a loan made available to provide a direct bonus for small businesses to still help their workers remain on the business payroll. The Paycheck Protection Program was originally raised with a sum of $350 billion intended to help small businesses in the United State of America with eight weeks of cash-flow aid via 100 percent guaranteed loan from the federal government. The Paycheck Protection Program loans are strengthened by the Small Business Administration (SBA). FEATURES OF THE PAYCHECK PROTECTION PROGRAM (PPP)

E. ECONOMIC INJURY DISASTER LOANS (EIDL)The Economic Injury Disaster Loan is set down to assist small businesses to gain victory over the momentary loss of gross they are encountering because of the Covid-19 pandemic. The Economic Injury Disaster Loan is fundamentally brought about for businesses to use in paying fixed debt, account payable, payroll, and other monetary bills that can be paid because of the pandemic (and that the Paycheck Protection Program loan did not already cover). FEATURES OF THE ECONOMIC INJURY DISASTER LOAN (EIDL)

F. SBA EXPRESS BRIDGE LOANSBusinesses that already have a standing relationship with SBA Express Lender are helped by the SBA Express Bridge loan to speedily get a loan up to $25, 000. The SBA Express Bridge loan aims to help small businesses overcome any momentary loss of revenue they are encountering because of the Covid-19 pandemic.

FEATURES OF THE SBA EXPRESS BRIDGE LOANS

Cox online media announces business funding deal, to buy advertising rights of private websites and even buy entire websites .Cox online media is currently contacting website owners, to purchase there entire websites, buy there advertising rights, or give them business funding . Cox online media is working with private funding sources, to purchase these websites and provide them with business funding. Cox online media will pay one years advertising revenue to purchase almost any website, or it will give websites $300 to $500,000 in business funding regardless of credit.Cox online media will pay you 1,200% of your monthly ad revenue to buy your website, or in conjunction with GuaranteedBusinessFunding.org will provide 250% monthly advertising revenue, in no credit needed, no questions asked business funding to website owners.100% of all applications that meet these qualifications will be reviewed for immediate funding. If you are wanting to get business funding for your website, you can do so here via this link http://www.guaranteedbusinessfunding.org/apply.html but if you want to sell your website to coxonlinemedia.com please fill out the sell your website link on this website or click here This is the most liberal funding program for website owners.A new program has been made to help restaurants in need. This program will fund restaurants from $2,500 to $500,000. This program is regardless of credit and is a joint venture of https://orderandeatapp.com/ , https://about.dylish.com/ , http://www.mytogoorders.com/, and https://restaurantfundingnow.com/ .

contractors can buy material from any stone or building material supplier in the USA and pay 90 days later with the new program .Guaranteed Business Funding has made a deal to provide financing to a company that buys stone and building materials from any US supplier you ask them to buy from them then sell it to you and give you 90days to pay, this company is called AmericanStone.org to supply to contractors to purchase building materials through its website that’s free for stone yards to sell on AmericanStone.org with this new partnership contractors in any state in the USA can buy building materials from any supplier in the USA via the AmericanStone.org website, when they do this they can pay up to 90 days later for any materials they buy. With the new program Stone yards and building materials suppliers are paid for the materials and stone when the contractors receive the materials from the website AmericanStone.org and the contractors then have 90 days to pay AmericanStone.org . So far AmericanStone.org has charged no fees to any stone yard or building materials sellers and acts as as a free service to these sellers currently although many stone yards and building suppliers offer them special pricing often called “builder pricing“ allowing them to keep the difference to incentivize there help and get better marketing placement on its websites and a broader array of marketing support. For stone yards and building materials suppliers wanting to offer 90 day financing to your customers but still get paid up front .You can signup if your a stone yard or building material supplier directly with AmericanStone.org , its free to signup and have them sell your stone and building materials and when your customers buy from them you still get paid upfront and your customers get up to 90 days to pay the invoice to us (which you has already been paid for) For contractors wanting 90 days to pay your invoices to building materials suppliersIf you are a contractor, builder or are in the construction business AmericanStone.org can place your building materials orders and pay your invoices for you and you can get your materials now and pay the website AmericanStone.org in 90 days (bad credit is ok)

To pay your invoices 90 days later but get your materials now , all you have to do is have AmericanStone.org order the stone for you, we pay your suppliers now and you get your building materials now but you pay AmericanStone.org back in 90 days to get started and order get your materials now but pay in 30 days register on the website AmericanStone.org or you can email RockIt@AmericanStone.org with the invoice of the stone you want to buy ( or other building materials you want to buy) a picture of the Material being bought (camera phone fine) and when you need us to purchase the materials for you. Once this is done we will review your order, then send you some paperwork to finalize , once finalized we place the order, you get your materials and 90 days later your bill will be due to be paid for the materials that AmericanStone.org ordered for you/sold you . if you have questions feel free to contact AmericanStone.org at Sales@AmericanStone.org New Covid program to fund restaurants $2,500 to $500,000 subsidized by online ordering platforms11/9/2020 Valid for all US restaurants with monthly sales of $5,000 or more regardless of your credit!This new program to help restaurants due to the continued Covid pandemic ,despite the vaccine being announced it may be months before the entire population has the vaccine so it’s safe to prepare for a prolonged duration of online ordering, and reduced in restaurant dining . Restaurants must have sales of at least $5,000 a month and must be owned by a U.S. citizen 18 years or older with valid photo ID and a business checking account for there restaurant to qualify for the Covid restaurant funding program . the program does have limitations, you can get $2,500 to $500,000 regardless of credit because this Covid funding program is subsidized by ordering platforms mytogoorders.com Dylish.com And the orderandeatapp.com. As such you will be required to open accounts with one of these platforms in order to get the $2,500 to $500,000 in funding being offered and subsidized by the ordering platforms

The basics:

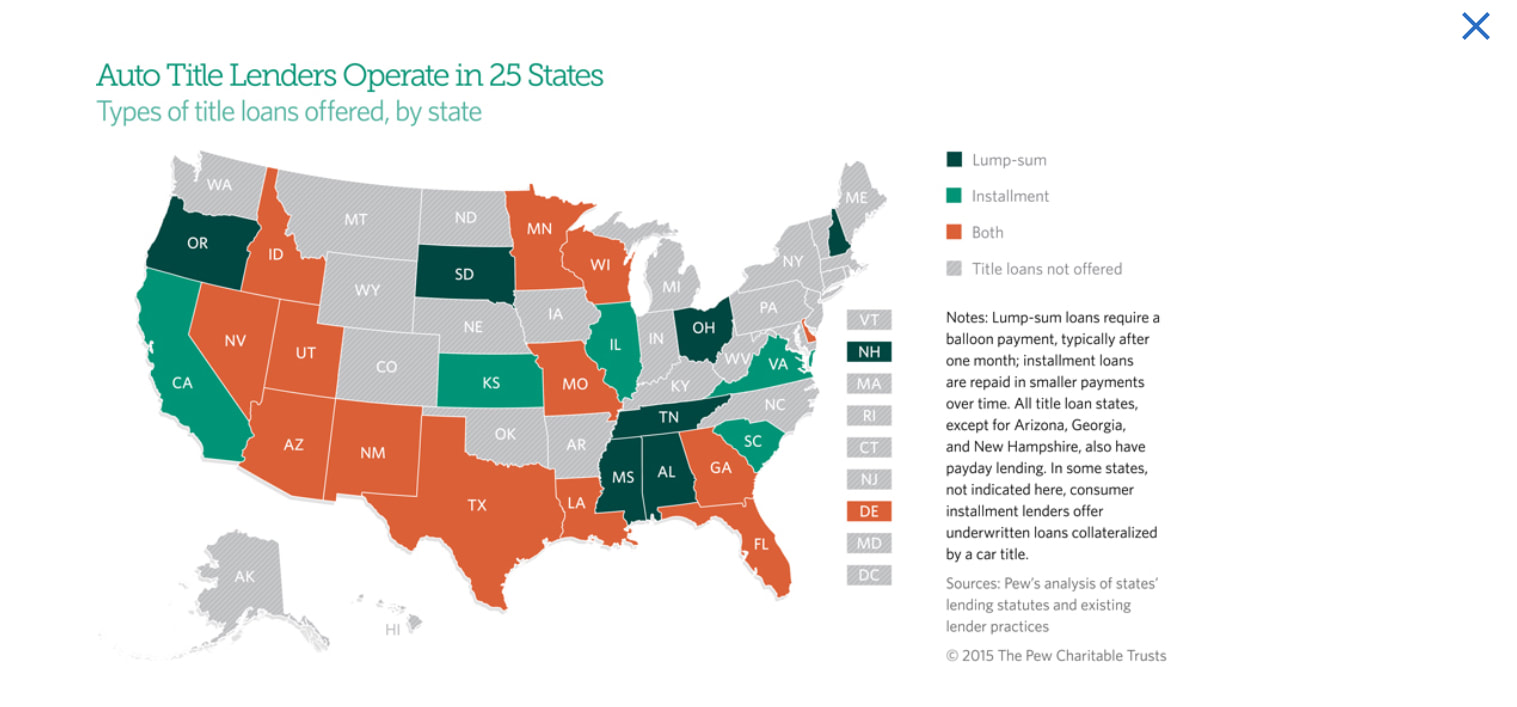

Today’s economy is abrupt and your cash flow might be to rocky, with highs and lows in your income and this can scare investors , which are the ones that decide if you get funding or not. However not with all investors . Car title loans can solve problems for business owners who can’t get funding because they have bad cash flow and poor credit. Car title loans and get you funding even if you have bad credit or no credit and even if you have poor cash flow. Car title loans benefits: credit is not generally a factor in funding cash flow is not a factor normally in funding simple, to get, car title loan companies verify ownership of your vehicle and then fund you. Here in this graph from pew charitable trust we see that title loans are available nationwide but there are different types of title loans available by state as you can see here fast! Car title loans can often be approved within an hour ! simple terms and payment plans less expensive than many other types of funding for those with bad credit and poor cash flow, like pay day advances or super high cost Indians reservation loans. But how do you get a car title loan, what do they cost, and which car title loan companies are the best? We will answer this all for you in our next post! Two types of title loans , what’s the cheapest ?Single Payment Title Loans tend to be the cheapest but how cheap can they be? as the name suggest these loans just have 1 payment! Title loans with single payments require the full loan amount, plus interest and fees, to be paid in full by the due date. These loans typically have a term of one month or 30 days. Interest for these types of title loans is very easy to calculate because there is only one payment. For example, let’s say we borrow $1,000.00 for one month at a Monthly Rate of 15%. The loan is due in one month, and we are required to pay the loan in full. Because there is only one payment, there is no need to amortize the loan (more on amortization later). We simply need to figure out how much we will owe at the end of the one month. To calculate the interest we simply multiply the Principal Amount times the Monthly Rate. We have the principal amount (the $1,000.00) and we have the monthly rate (15%). So the interest accrued during the loan term is: $1000.00 x 15% = $150. This means we will need to repay the principal amount, plus the interest, by the due date. So single payment car title loans can cost just 15% according to this scenario. |

Archives

May 2022

Categories |

RSS Feed

RSS Feed