|

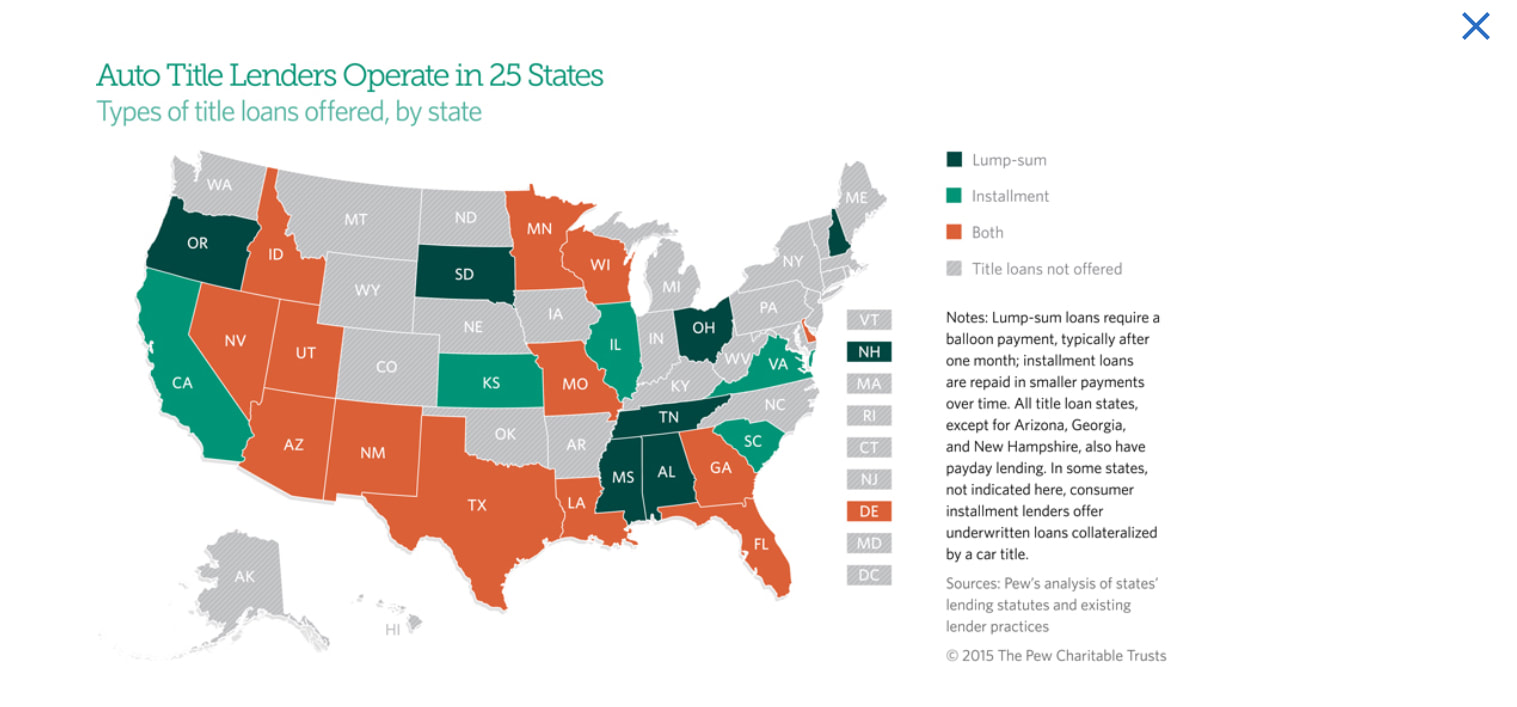

Today’s economy is abrupt and your cash flow might be to rocky, with highs and lows in your income and this can scare investors , which are the ones that decide if you get funding or not. However not with all investors . Car title loans can solve problems for business owners who can’t get funding because they have bad cash flow and poor credit. Car title loans and get you funding even if you have bad credit or no credit and even if you have poor cash flow. Car title loans benefits: credit is not generally a factor in funding cash flow is not a factor normally in funding simple, to get, car title loan companies verify ownership of your vehicle and then fund you. Here in this graph from pew charitable trust we see that title loans are available nationwide but there are different types of title loans available by state as you can see here fast! Car title loans can often be approved within an hour ! simple terms and payment plans less expensive than many other types of funding for those with bad credit and poor cash flow, like pay day advances or super high cost Indians reservation loans. But how do you get a car title loan, what do they cost, and which car title loan companies are the best? We will answer this all for you in our next post! Two types of title loans , what’s the cheapest ?Single Payment Title Loans tend to be the cheapest but how cheap can they be? as the name suggest these loans just have 1 payment! Title loans with single payments require the full loan amount, plus interest and fees, to be paid in full by the due date. These loans typically have a term of one month or 30 days. Interest for these types of title loans is very easy to calculate because there is only one payment. For example, let’s say we borrow $1,000.00 for one month at a Monthly Rate of 15%. The loan is due in one month, and we are required to pay the loan in full. Because there is only one payment, there is no need to amortize the loan (more on amortization later). We simply need to figure out how much we will owe at the end of the one month. To calculate the interest we simply multiply the Principal Amount times the Monthly Rate. We have the principal amount (the $1,000.00) and we have the monthly rate (15%). So the interest accrued during the loan term is: $1000.00 x 15% = $150. This means we will need to repay the principal amount, plus the interest, by the due date. So single payment car title loans can cost just 15% according to this scenario.

0 Comments

|

Archives

May 2022

Categories |

RSS Feed

RSS Feed